The residential photovoltaic market in England from 2010 to 2019 had a great stimulus as it was strongly encouraged by the Government through a generous incentive on energy production by a PV system that was added to the energy fed into the grid, a mechanism similar to what happened in Italy with the “Conto Energia” but very more profitable.

Residential photovoltaic plants in the five-year period 2010/2015 more than 150 MW each year

Most of the installations of residential photovoltaic systems were connected to the grid in the five-year period 2010/2015 with more than 150 MW each year with a peak of 560 MW in 2015.

In recent years, the incentive rate has dropped with the consequent impact on new installations which stood at around 100 MW, bringing the cumulative to 2.352 MW in 2019.

Battery installations on residential systems

The first batteries installations on residential systems in the UK began in 2015 thanks to the lowering of prices and the emergence of new tariffs on electricity based on “time-of-use” logics and, starting from the 1st of January 2020, also on “Smart Export Guarantee” logics. These criterions of retail electricity tariffs states that every energy retailer is obliged to purchase the energy exported to the grid by small plants.

As well as the photovoltaic system, in these new logics are also considered the batteries with a very boosted liberalization that gives the possibility to design one’s own purchase and sale rate.

This mechanism makes it profitable to charge the battery from the grid when the tariffs are very low and to export the stored energy to the grid when the sales tariffs allows it.

Situation of the British market in 2020

Since there are no other incentive for the installation of batteries, the market from 2016 onwards has not experienced high growth rates.

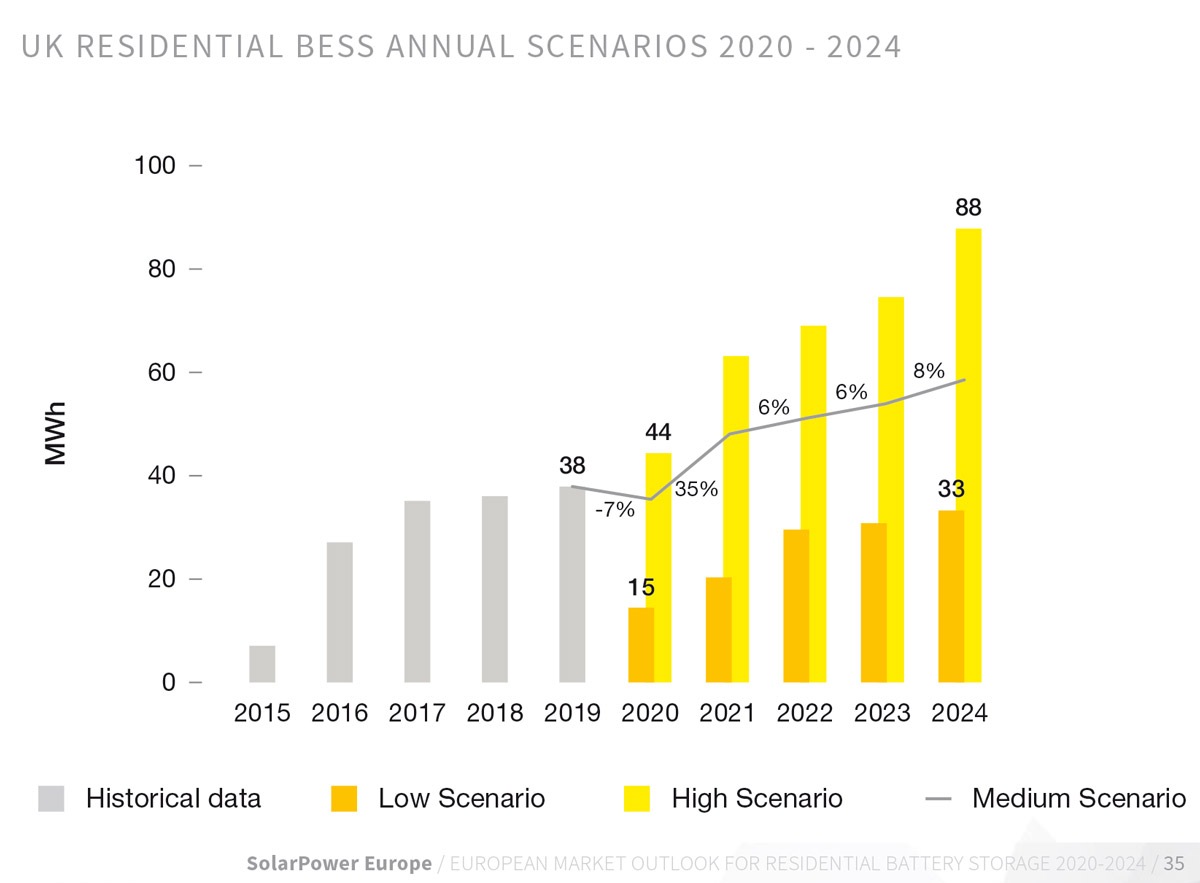

In this 2020 where COVID-19 has hit the UK hard together with the uncertainties about Brexit and the consequent logic on customs duties, will probably lead to a decrease in numbers of installation after having seen the connection to the grid of 36 MWh in 2018 and to the 38MWh in 2019, with approximately 1% increase if compared to the previous year.

Future perspectives from 2021 according to SolarPower Europe

The prospects from 2021 onwards made by SolarPower Europe in its European Market Outlook For Residential Battery Storage 2020-2024 indicate in their average scenario an increase of 35% with an installed that should reach 48 MWh, and then stabilize and a growth rate around 6-8% in the three-year period 2022-2024.