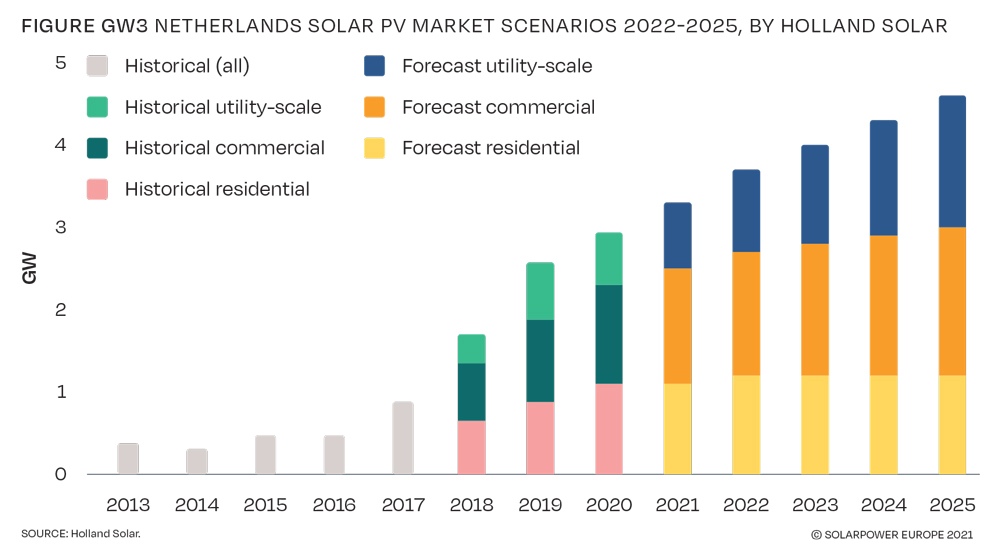

The Netherlands according to Solar Power Europe’s EU Market Outlook For Solar Power 2021 – 2025 is the third nation for installations in 2020 with 2.9 GW with forecasts to have installations for 3.3 GW in 2021, always remaining in third place in our continent.

12 GW of incentivized projects

Although the last two years have been characterized by the crisis due to the pandemic from Covid-19, the Netherlands has placed, through its SDE ++ incentive scheme which is based on tenders, projects for 12 GW that include both commercial and ground-mounted systems, but other technologies as well.

According to data from Solar Power Europe, about 70% of the projects that have been awarded the contract are completed, despite the slowdowns in the installation and connection of medium/large projects are mainly due to the inadequate grid infrastructure.

Despite this, the forecasts are to see more than 3.5 GW connected in 2022 and 4 GW in 2023.

Subdivision by power, commercial, residential and utility-scale sectors

The partition by power sectors in the Netherlands sees the systems in the commercial segment have a share of over 40%, the residential one around 40%, while the utility-scale ground-mounted less than 20%.

In the Netherlands, projects are also being developed for both large floating PV plants, but also carpot.

Environmental biodiversity labeling system

The Netherlands has established a labeling system on environmental biodiversity linked to these types of PV systems managed by Wageningen University, in this way many resistances that have occurred and could have from citizens and local NGO have failed, since this independent organization certifies other advantages to nature that must derive from the specific installation in addition to the production of green energy.

Incentive for small residential systems based on feed-in tariff

The growth of installations in the Netherlands is expected on several fronts, on the one hand the small residential systems still enjoy an incentive based on the feed-in into the grid, the incentive is calculated to have a payback time of about 7 years on average self-consumption 30%, therefore very convenient for homeowners, in fact already about 1/5 is already equipped with a PV system.

On the other hand, this system discourages the installation of storage batteries since the network is seen as a sort of “virtual battery”. However, a review of this mechanism is envisaged.

SDE++ incentive for the commercial and utility-scale sector

For the commercial and utility-scale sector, the growth challenges related to the SDE++ incentive are many as it incorporates many different renewable sources technologies, but also includes CCS (CO2 capture and storage) systems as the auctions are assigned based on the price per ton of CO2 avoided and the maximum incentive decreases from year to year.

In this way, if the Dutch government does not mitigate this decrease, given the increases in the costs of PV modules, and of course, also the other surrounding costs, it will become increasingly difficult for PV to compete with other technologies.

In any case, in the auction of October 2020 3.6 GW were assigned in various PV systems of various sizes that are still to be installed and connected to the grid.

Growth forecasts for the next few years conditioned by the policy and grid infrastructure

According to the forecasts of Solar Power Europe we can expect grid-parity starting from 2023 on utility-scale plants and that from 2025 without incentives it will be possible to have installations of large systems with the mechanism of the PPA (Power Purchase Agreement), all due to rising electricity prices.

In conclusion, the EU Market Outlook For Solar Power 2021 – 2025 for the Netherlands has two faces, on the one hand installation increases are expected, but strongly conditioned by the policy and the grid infrastructure.